Image source: bbcimg.co.uk

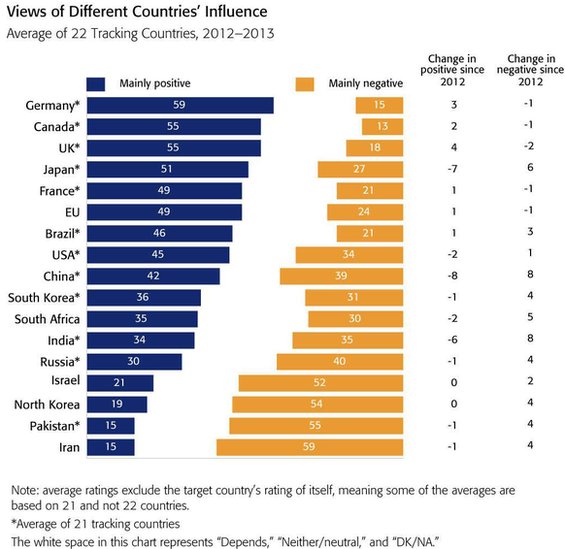

A BBC survey positions Germany as the most popular country in 2013, voted for by nearly 60 per cent of the poll’s global participants. Europe’s largest economy moved to the top spot to displace Japan, whose positive ratings fell from 58 percent to 51 percent.

“There are lots of reasons why Germany is admired,” Alastair Newton, a political analyst at Japanese investment bank Nomura, was quoted in reports. “It is a large and important world economy, a world-class manufacturer, and has a chancellor who demonstrates genuine leadership. The question also is, where else would it be? It is hardly likely to be the US, given their attitude to the Middle East, or China given Western and Japanese concerns on the country.”

Image source: travelfox.com

Germany’s leap to number one was helped by agreeable reviews from respondents in Spain, France, Ghana, and Australia.

It is worth noting that an equally positive assessment for Germany was not shared by some of its neighbors in the Euro in the wake of sovereign debt and financial crises. In stark contrast to its poll showing, Germany had scored in the red by the hand of respondents from Greece, which had suffered a particularly thorny economic life. Chancellor Angela Merkel’s government was largely looked upon for financial bailouts, which it had strained to release in favor of high-handed fiscal reforms. Other Euro members, such as Italy, are raising hackles at Germany’s strict debt management solutions, as social welfare in financially challenged European economies takes a beating.

Image source: merriam-webster.com

The United Kingdom, following a successful hosting of the 2012 Olympic Games, also improved its ratings and climbed to the third spot. Israel, North Korea, Pakistan, and Iran got the least favorable ratings.

I am Dana Ray Reynolds, a financial planner who provides assistance to businesses and individuals on their investment decisions, particularly in the areas of risk management and tax planning. Follow me on Twitter for more updates.